ADYEN FY23--Showing form in a tough game.

ADYEN FY23—New generation Payments Platform

There is little doubt that beyond the “rails’ businesses in

payments being V and MA, the other players face a difficult, competitive, and

dynamically changing environment. There is a race to the bottom in margins with

technology constantly evolving, competitive advantage looks hard to maintain.

Global payments are also a massive market. Those who can

gain some advantages are likely to gain significant volumes although the sustainability

of those returns can be unclear.

ADYEN is a new operator, developed by experienced and previously

successful operators in the field. Built off a single integrated platform (no

third parties) with the ability to integrate different payment methods and handle

cross-border and complex payments it is truly the best in class, but also the

most expensive. With technology evolving the legacy providers are potentially

caught, counter-positioned where the need to change fights the fear of disrupting

yourself. Management built the tech stack to take advantage of the evolution

and what they knew would be difficult for the incumbents to replicate.

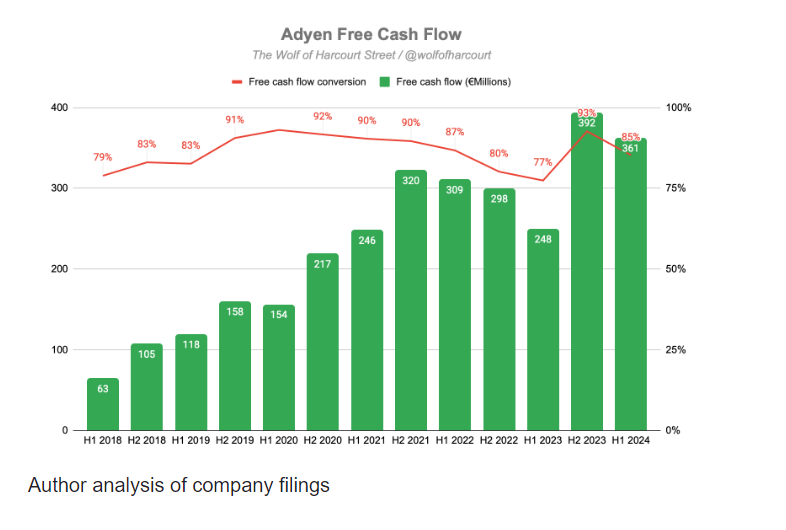

The attraction to Adyen was that even in its relatively

early days, it saw both robust top-line growth and healthy bottom-line profitability.

Being European-based also allowed them to build scale in a more benign

environment at a cost below anything in the US.

The cost to the merchant of interchange is quite large say

2% of the sale, but only 20bp of that goes in Adyen, very approx. estimates

here. The point is that the charge is small in the broader scheme of things

even though the V/MA payments are small, most of the money goes to the issuer

bank and is recycled into rewards programs.

Competition is fierce with legacy providers as well as newer

operators such as Paypal and probably the most significant competitor, Stripe

in the US. Lots of little niche operators. Customers often switch some volumes

to test operators and keep everyone else honest on pricing. Adyen is the

premium product and bases that premium on the total cost of ownership which

aggregates, better conversion rates, lower fraud, and the ability to improve

client operational efficiencies with scale (one multi-faceted solution).

Several months ago there was a lull in the growth when more

resources were needed and growth slowed. The share price tanked and the pricing

became more reasonable.

Adyen appeals to global businesses with its easy integration

of multiple payment platforms and currencies. The domestic US was likely the

difficult market to crack being more concentrated in payment type, price

conscious and homogeneous.

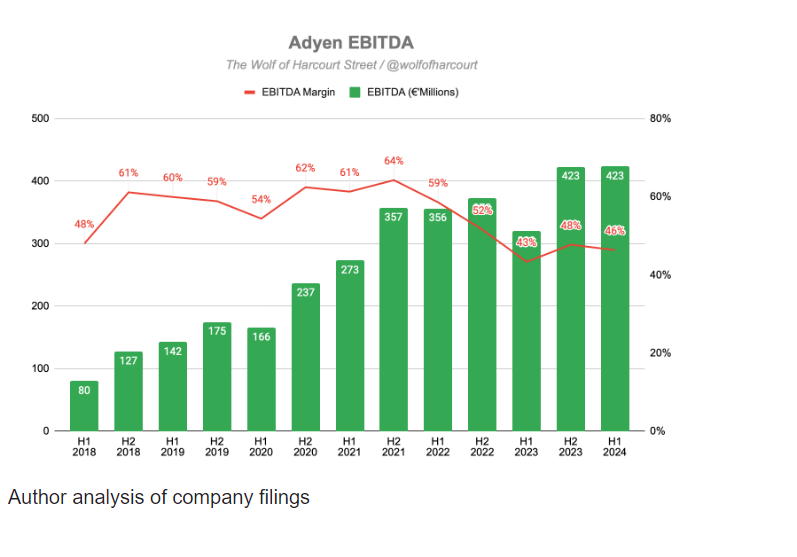

The Fy23 results show the company reiterate 20-30% revenue

growth for the next several years and margins to increase in 2024 from 2023 but

improve further into 2025 and 2026. Ebitda margins of over 50% were possible,

from the 42% currently impacted by the growth costs recently added.

The 2H result also showed a new large customer in the US,

Cash App, as well as new verticals and very good growth in the highly

competitive US market. A very positive outcome.

Valuation Below scenario analysis shows not too much upside,

in fact, flat at best.…5 year cagr

|

|

|

|

Please note the disclaimer.

3. Adyen (Ticker: ADYEN) Market Leadership and Latest PartnershipsRecognized as a Leader by IDC MarketScapesAdyen has been recognized as a Leader in the 2024 IDC MarketScape assessments for both Retail Online Payment Platform Software Providers and Retail Omnichannel Payment Platform Software Providers. This recognition highlights Adyen's comprehensive solution, innovation, and merchant focus. Key insights include:

Source: Adyen IR My Perspective: Adyen is the best in the business at what it does. You don’t just have to take my word for it; we can see how industry experts rank it compared to the competition.

Partnership with SumUpAdyen and SumUp have entered into a strategic partnership to enhance the payment experience and accelerate settlements for small businesses globally. This collaboration aims to provide SumUp's merchants, particularly small and micro merchants in Europe and the UK, with faster access to their funds, enabling same-day settlements every day of the year. The partnership addresses critical cash flow needs by allowing merchants to receive their payments within minutes rather than days, reducing the need for large working capital reserves. SumUp serves over 4 million merchants across 36 markets. Source: Adyen IR Partners with MECCAAdyen has partnered with MECCA, Australia’s largest prestige beauty retailer, to enhance its payment systems both in-store and online. MECCA, which has been a leading beauty retailer for 27 years with over 110 stores and a strong e-commerce platform, aims to improve its customer experience and fraud protection through this partnership. MECCA selected Adyen to streamline the payment process, ensuring reliability and simplicity for customers, whether they shop online or in-store. This includes the adoption of Adyen's Unified Commerce and Pay-by-Link technologies. Source: Adyen IR My Perspective: By partnering with companies in different industries, Adyen is diversifying its client base and expanding its reach across various sectors. Both partnerships showcase Adyen's ability to integrate its advanced payment technologies with different business models and needs. |

Comments

Post a Comment