CCP --its evolved into a trading stock $12-20 range.

CCP FY24 – it’s a trading stock.

Companies evolve, sometimes quickly, sometimes slowly,

sometimes for the better sometimes not.

Once I regarded CCP as a long-term holding, a quality stock that

can add assets consistently above its cost of capital. Things have changed.

My classification of CCP is as a lender. The core business,

in which it is the leader, was ANZ debt ledgers. The knowledge and discipline displayed

by management compared to the variable competition put them in a strong

position to build the business. The core debt ledger business is shrinking, I

am not too sure whether it is cyclical or structural, I can make arguments both

ways, but I will err to the conservative and assume structural until proven incorrect.

To replace the lack of growth in ANZ debt ledgers, management

has gone into the US debt ledger market and consumer lending in ANZ. I suspect

the US debt ledger market is difficult, but I know ANZ's low-quality lending is

a difficult business. I have no doubt both are of poorer quality than the

original core business.

Where does that leave us? Well, lending is cyclical and usually

has a record of sunny days, with the occasional and inevitable hurricane of

losses when dealing with the low-quality lending end of the market.

CCP is then a trading stock, when it gets hit, check the extent

of the damage, there is a risk to the balance sheet—more equity is required?, wait

until clear on this point. Then comes the big one, Does management have the

ability and forthrightness to assess the damage? CCP management have a history

of being upfront and also account for losses very conservatively, provisioning

away 3 years losses. That gives you a measuring stick.

After the shock comes the earnings recovery back to

normalised lending results and the share price recovers.

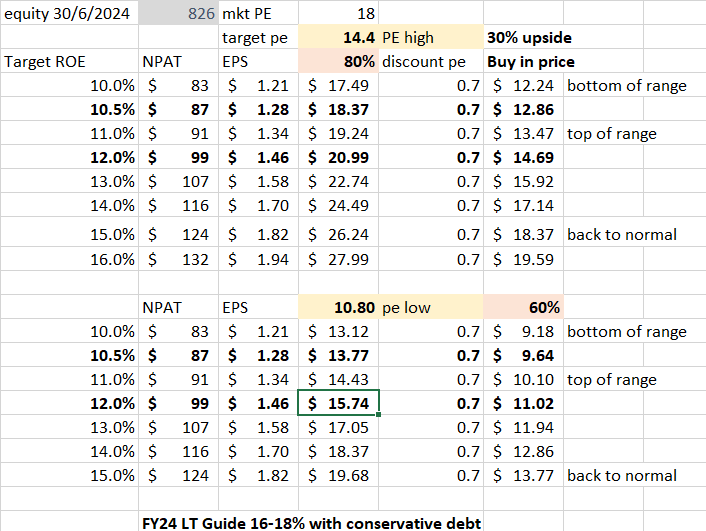

To value the stock, as with many financial stocks, I prefer

the balance sheet as a starting point. CCP gives a LT ROE target 16-18% lower than

its historic results. The mix business mix has changed with the preferred core business

much smaller than the other two, which lends itself to lower ROEs on a sustainable

basis, IMO. Even if the earnings were higher I would capitalise them at a lower

rate.

My valuation scenario analysis is below. Simply using, SHF and ROE together with a PE.To me it’s a trading stock $12-18 range, above $20 take profits. Usually, I wouldn’t put a lot of effort into trading stocks, but since I have the history and data with this one I'll continue to watch it. Probably an opportunity every 5 years or so to double your money, Imo.

Please note the disclaimer

Comments

Post a Comment