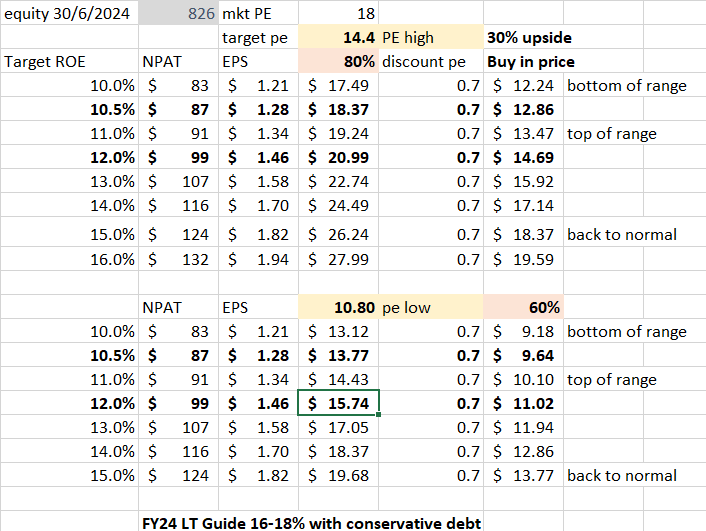

CCP --its evolved into a trading stock $12-20 range.

CCP FY24 – it’s a trading stock. Companies evolve, sometimes quickly, sometimes slowly, sometimes for the better sometimes not. Once I regarded CCP as a long-term holding, a quality stock that can add assets consistently above its cost of capital. Things have changed. My classification of CCP is as a lender. The core business, in which it is the leader, was ANZ debt ledgers. The knowledge and discipline displayed by management compared to the variable competition put them in a strong position to build the business. The core debt ledger business is shrinking, I am not too sure whether it is cyclical or structural, I can make arguments both ways, but I will err to the conservative and assume structural until proven incorrect. To replace the lack of growth in ANZ debt ledgers, management has gone into the US debt ledger market and consumer lending in ANZ. I suspect the US debt ledger market is difficult, but I know ANZ's low-quality lending is a difficult business. I have no ...